Reprinted with AIS Health permission from the Dec. 7 issue of Radar on Medicare Advantage

Insurers are more carefully tailoring their preventive supplemental benefit offerings to support Medicare Advantage enrollees aging in place, with benefits such as home and bathroom safety modifications more than doubling between 2023 and 2024, according to a new Faegre Drinker analysis of Plan Benefit Package (PBP) data. But as CMS takes steps to gather more data on supplemental benefits, less impactful benefits could be thinned from the pack while those with greater potential to improve health outcomes are embraced by insurers.

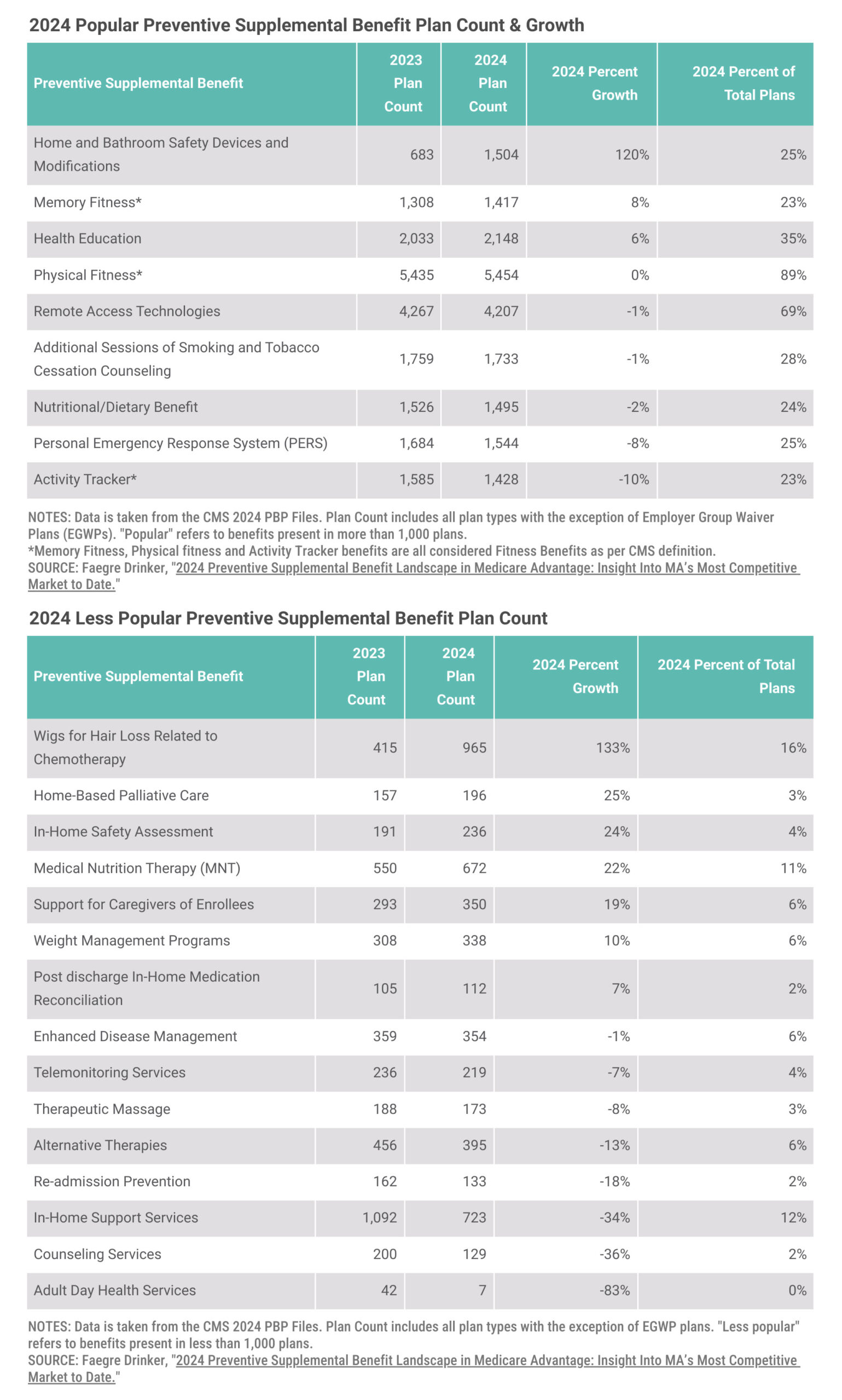

Faegre Drinker has been tracking the growth of supplemental benefits since 2021, when MA insurers were in the early days of experimenting with new offerings under CMS’s reinterpretation of “primarily health related” supplemental benefits. The latest analysis, published on Dec. 5 and shared in advance with AIS Health, focuses on the preventive supplemental benefit market due to the large variance in uptake, with some benefits offered by fewer than 100 plans and others featured in more than 5,000 PBPs. This year, Faegre Drinker split the categories into two types: popular (i.e., offered by more than 1,000 plans) and less popular (i.e., those offered by fewer than 1,000 plans).

For 2024, home and bathroom safety modifications emerged as the fastest growing popular benefit, exhibiting growth of 120% from last year to be featured in 1,504 plans, or one-fourth of all plans excluding Employer Group Waiver Plans (EGWPs). The analysis includes MA Special Needs Plans, which are driving some supplemental benefit growth, but it did not look at the separate category of Special Supplemental Benefits for the Chronically Ill (SSBCI). According to recent research from ATI Advisory with funding from the SCAN Foundation, fewer MA plans are using SSBCI to offer non-primarily health-related benefits such as food and produce, non-medical transportation, social needs benefits and general supports for living. Some of those benefits, however, are being included in more PBPs through the MA Value-Based Insurance Design model, observed ATI.

The Faegre Drinker analysis, meanwhile, showed that nutrition/dietary benefits will be offered by 1,495 MA plans next year, representing a 2% decline from this year after a 5% increase between 2022 and 2023. Nevertheless, such benefits continue to be offered by 24% of plans. Two other popular benefits that saw declines are personal emergency response systems (PERS) and activity trackers, which are featured in 8% and 10% fewer PBPs next year, respectively. The report’s author, Vincent Giglierano, suggests that the decline of PERS is likely due to seniors’ increasing use of smart technology, whether it’s through an Apple watch, cellphone, or other technology in the home. “Why not let Apple deal with it for a person who’s already paying for it rather than pay for a service where you have to have someone on a 24/7 call?” points out Giglierano, who is senior manager of health services research with Faegre Drinker.

Memory Fitness Benefits Gain Steam

Per CMS’s definition of “fitness benefits” for PBP filing purposes, activity tracker, memory fitness and physical fitness benefits all fall into that category. For the second year in a row, memory fitness was one of the fastest-growing preventive supplemental benefits. For 2024, it will be included in 1,417 PBPs, or 23% of all plans, compared with 1,300 PBPs in 2023. Along with increased interest in health education, home/bathroom safety and remote access technologies, Giglierano remarks that this reflects a continued emphasis on supporting seniors aging in place.

Henry Mahncke, Ph.D., CEO of Posit Science Corp. — the maker of BrainHQ online brain training exercises — is thrilled that more insurers are recognizing the cognition-improving potential of memory fitness. “Everyone knows brain health is a top concern of older adults. Last year, we worked with Deft Research to conduct a major survey among Medicare eligible adults and found more than 9 of 10 thought brain health was as or more important than physical health.” That’s why, he says, memory fitness is now included by 1 out of 4 plans that offer a gym benefit. In 2024, Posit Science will be working with 32 MA brands, up from 18 in 2023 and just three in 2021. “That’s pretty incredible growth,” he adds.

Posit Science isn’t deterred by CMS’s recent proposals around supplemental benefits. In addition to a requirement that MA plans send a midyear notification to enrollees of their unused supplemental benefits, CMS in a proposed rule suggested that plans begin demonstrating in their bids that an SSBCI can reasonably be expected to improve or maintain health through a “bibliography of evidence.”

“CMS is right to say that plans that offer benefits — and win at open enrollment — should be able to show that members put those benefits to work. Even though BrainHQ is a pretty new benefit, the usage rates are comparable to gym benefits (with percentages of eligible members in the low single to double digits range), while the benefit cost is much lower,” Mahncke tells AIS Health, a division of MMIT. “The single largest factor driving higher usage is just letting members know about the benefit. And not just as one line in a bland multi-page [Annual Notice of Change]. We see the best results when members get a specific communication about a plan’s fitness benefits, with peppy language and compelling call to action to take advantage of BrainHQ. We work closely with plans on these kinds of emails and direct mails, and the results are great.”

Moreover, if CMS starts to become stricter about what benefits are going to qualify in certain categories, those with true potential to improve health outcomes will emerge victorious. “Technically under the guidance of a memory fitness supplemental benefits, you can just offer puzzle pieces, and that would” qualify, says Giglierano. Posit Science, for one, has evidence from peer-reviewed studies with promising results for those with mild cognitive impairment, he points out. “Certainly, the level of commitment on SSBCI is being able to maintain health status, and that’s a pretty low bar. So with the bibliography aspect, [CMS is] looking to raise that bar just a little bit.”

In general, “the Biden administration is becoming a little bit more hesitant towards the Medicare Advantage program,” he continues. “And we’ve seen commercial supplemental benefits that might be more marketable, but certainly with the complaints about the marketing, and then also the proposed rule to require to SSBCI plans to have a bibliography…they’re paying more attention to health outcomes. Health outcomes and marketability have always been two sides of the same coin. And the good plans that do it well are able to do both. But it certainly seems that the Biden administration is trying to place more emphasis on health care as a means to [drive] health outcomes as opposed to a competitive landscape.”

Lauren Flynn Kelly

Lauren has been covering health business issues since the early 2000s and specializes in in-depth reporting on Medicare Advantage, managed Medicaid and Medicare Part D. She also possesses a deep understanding of the complex world of pharmacy benefit management, having written AIS Health’sRadar on Drug Benefits from 2004 to 2005 and again from 2011to 2016. In addition to her role as managing editor of Radar onMedicare Advantage, she oversees AIS Health’s publications and manages the health editorial staff. She graduated from Vassar College with a B.A. in English.